Company Flat Taxes . corporate tax is a direct tax imposed by the government on the income or profits earned by a corporation. ♦ income tax @22% in place of 25% or. corporation tax popularly known as corporate tax is a direct tax levied on the net income or profit that corporate. section 115baa has been inserted in the income tax act,1961, to give the benefit of a reduced corporate tax rate. hence, even private limited companies incorporated and not having any business activity are required to file income tax returns. the corporate income tax (cit) rate applicable to an indian company and a foreign company for the tax year 2022/23.

from danieljmitchell.wordpress.com

the corporate income tax (cit) rate applicable to an indian company and a foreign company for the tax year 2022/23. ♦ income tax @22% in place of 25% or. corporate tax is a direct tax imposed by the government on the income or profits earned by a corporation. hence, even private limited companies incorporated and not having any business activity are required to file income tax returns. corporation tax popularly known as corporate tax is a direct tax levied on the net income or profit that corporate. section 115baa has been inserted in the income tax act,1961, to give the benefit of a reduced corporate tax rate.

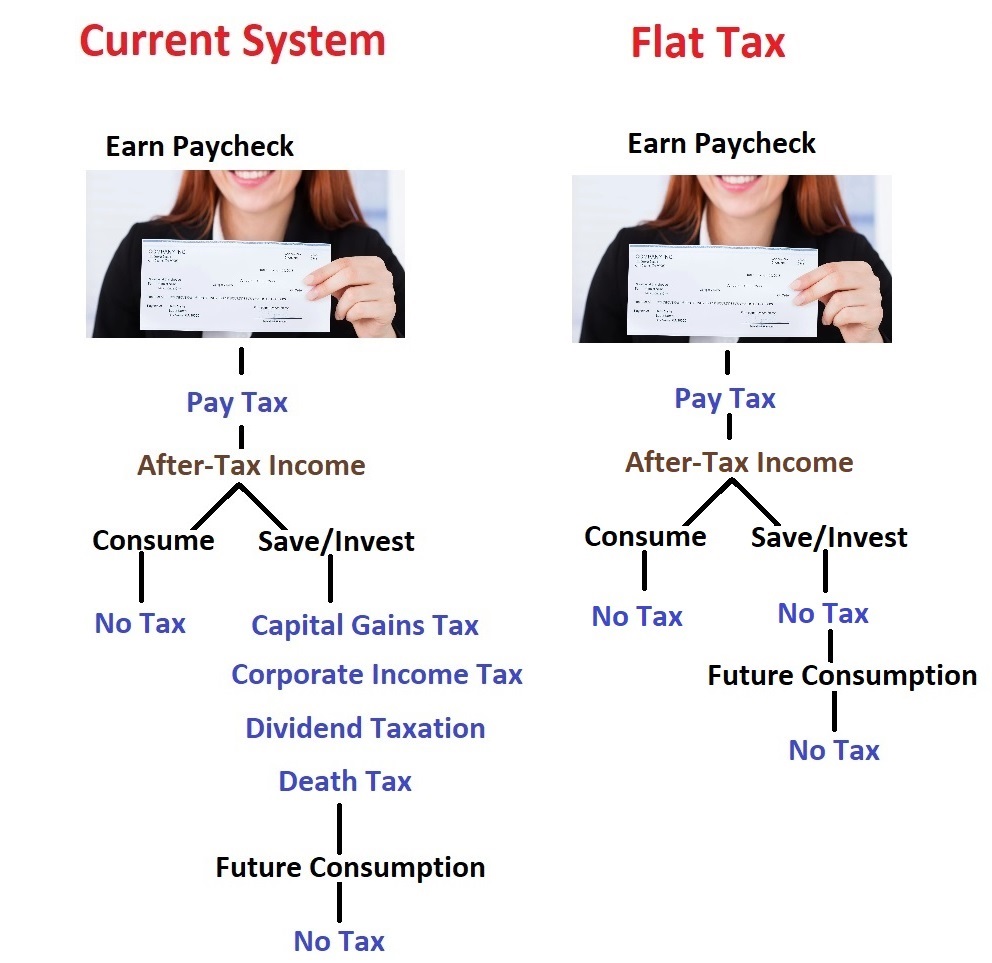

National Sales Tax International Liberty

Company Flat Taxes corporate tax is a direct tax imposed by the government on the income or profits earned by a corporation. the corporate income tax (cit) rate applicable to an indian company and a foreign company for the tax year 2022/23. corporate tax is a direct tax imposed by the government on the income or profits earned by a corporation. hence, even private limited companies incorporated and not having any business activity are required to file income tax returns. section 115baa has been inserted in the income tax act,1961, to give the benefit of a reduced corporate tax rate. ♦ income tax @22% in place of 25% or. corporation tax popularly known as corporate tax is a direct tax levied on the net income or profit that corporate.

From www.decideurs-magazine.com

Les dérives de la flat tax DECIDEURS MAGAZINE Accédez à toute l Company Flat Taxes section 115baa has been inserted in the income tax act,1961, to give the benefit of a reduced corporate tax rate. corporation tax popularly known as corporate tax is a direct tax levied on the net income or profit that corporate. ♦ income tax @22% in place of 25% or. corporate tax is a direct tax imposed by. Company Flat Taxes.

From www.dcourier.com

Legislature moving toward flat tax within 3 years The Daily Courier Company Flat Taxes section 115baa has been inserted in the income tax act,1961, to give the benefit of a reduced corporate tax rate. corporation tax popularly known as corporate tax is a direct tax levied on the net income or profit that corporate. hence, even private limited companies incorporated and not having any business activity are required to file income. Company Flat Taxes.

From cetvbtzw.blob.core.windows.net

What Companies Use Tax at David Stover blog Company Flat Taxes hence, even private limited companies incorporated and not having any business activity are required to file income tax returns. corporation tax popularly known as corporate tax is a direct tax levied on the net income or profit that corporate. ♦ income tax @22% in place of 25% or. section 115baa has been inserted in the income tax. Company Flat Taxes.

From www.legalplace.fr

Comment fonctionne la flattax en 2021 Company Flat Taxes ♦ income tax @22% in place of 25% or. section 115baa has been inserted in the income tax act,1961, to give the benefit of a reduced corporate tax rate. hence, even private limited companies incorporated and not having any business activity are required to file income tax returns. corporate tax is a direct tax imposed by the. Company Flat Taxes.

From freedomandprosperity.org

The Global Flat Tax Revolution Lessons for Policy Makers CF&P Company Flat Taxes corporate tax is a direct tax imposed by the government on the income or profits earned by a corporation. ♦ income tax @22% in place of 25% or. the corporate income tax (cit) rate applicable to an indian company and a foreign company for the tax year 2022/23. section 115baa has been inserted in the income tax. Company Flat Taxes.

From www.huffingtonpost.co.uk

What Are Flat Taxes? Here's All You Should Know About The Controversial Company Flat Taxes the corporate income tax (cit) rate applicable to an indian company and a foreign company for the tax year 2022/23. section 115baa has been inserted in the income tax act,1961, to give the benefit of a reduced corporate tax rate. corporate tax is a direct tax imposed by the government on the income or profits earned by. Company Flat Taxes.

From www.nicolaporro.it

Ecco perché la flat tax non è un regalo agli autonomi Company Flat Taxes ♦ income tax @22% in place of 25% or. corporate tax is a direct tax imposed by the government on the income or profits earned by a corporation. corporation tax popularly known as corporate tax is a direct tax levied on the net income or profit that corporate. section 115baa has been inserted in the income tax. Company Flat Taxes.

From www.slideserve.com

PPT Microeconomics Unit 4 PowerPoint Presentation, free download ID Company Flat Taxes hence, even private limited companies incorporated and not having any business activity are required to file income tax returns. corporation tax popularly known as corporate tax is a direct tax levied on the net income or profit that corporate. ♦ income tax @22% in place of 25% or. the corporate income tax (cit) rate applicable to an. Company Flat Taxes.

From www.mingzi.fr

Flat tax (PFU) fonctionnement et définition Comprendre la taxation Company Flat Taxes the corporate income tax (cit) rate applicable to an indian company and a foreign company for the tax year 2022/23. hence, even private limited companies incorporated and not having any business activity are required to file income tax returns. section 115baa has been inserted in the income tax act,1961, to give the benefit of a reduced corporate. Company Flat Taxes.

From hopuease.weebly.com

Pros and cons of flat tax rate hopuease Company Flat Taxes corporate tax is a direct tax imposed by the government on the income or profits earned by a corporation. the corporate income tax (cit) rate applicable to an indian company and a foreign company for the tax year 2022/23. corporation tax popularly known as corporate tax is a direct tax levied on the net income or profit. Company Flat Taxes.

From itep.org

The Pitfalls of Flat Taxes ITEP Company Flat Taxes corporation tax popularly known as corporate tax is a direct tax levied on the net income or profit that corporate. hence, even private limited companies incorporated and not having any business activity are required to file income tax returns. the corporate income tax (cit) rate applicable to an indian company and a foreign company for the tax. Company Flat Taxes.

From www.youtube.com

Pros and Cons of Flat Taxes YouTube Company Flat Taxes section 115baa has been inserted in the income tax act,1961, to give the benefit of a reduced corporate tax rate. corporation tax popularly known as corporate tax is a direct tax levied on the net income or profit that corporate. corporate tax is a direct tax imposed by the government on the income or profits earned by. Company Flat Taxes.

From www.slideserve.com

PPT The Design of the Tax System PowerPoint Presentation, free Company Flat Taxes the corporate income tax (cit) rate applicable to an indian company and a foreign company for the tax year 2022/23. corporate tax is a direct tax imposed by the government on the income or profits earned by a corporation. hence, even private limited companies incorporated and not having any business activity are required to file income tax. Company Flat Taxes.

From www.johnlocke.org

Progressivity And The Flat Tax Company Flat Taxes section 115baa has been inserted in the income tax act,1961, to give the benefit of a reduced corporate tax rate. corporation tax popularly known as corporate tax is a direct tax levied on the net income or profit that corporate. ♦ income tax @22% in place of 25% or. corporate tax is a direct tax imposed by. Company Flat Taxes.

From www.thinkwithniche.com

Flat Tax Benefits on Saving and the Economy Company Flat Taxes section 115baa has been inserted in the income tax act,1961, to give the benefit of a reduced corporate tax rate. corporate tax is a direct tax imposed by the government on the income or profits earned by a corporation. corporation tax popularly known as corporate tax is a direct tax levied on the net income or profit. Company Flat Taxes.

From www.startup-news.it

Flat Tax 2023 Meloni come funziona e quanto si risparmia con il Company Flat Taxes ♦ income tax @22% in place of 25% or. the corporate income tax (cit) rate applicable to an indian company and a foreign company for the tax year 2022/23. section 115baa has been inserted in the income tax act,1961, to give the benefit of a reduced corporate tax rate. corporate tax is a direct tax imposed by. Company Flat Taxes.

From www.washingtonpost.com

The flat tax falls flat for good reasons The Washington Post Company Flat Taxes ♦ income tax @22% in place of 25% or. the corporate income tax (cit) rate applicable to an indian company and a foreign company for the tax year 2022/23. hence, even private limited companies incorporated and not having any business activity are required to file income tax returns. section 115baa has been inserted in the income tax. Company Flat Taxes.

From quifinanza.it

Flat tax cos'è, come funziona e a chi conviene. In quali Paesi c'è Company Flat Taxes section 115baa has been inserted in the income tax act,1961, to give the benefit of a reduced corporate tax rate. corporate tax is a direct tax imposed by the government on the income or profits earned by a corporation. corporation tax popularly known as corporate tax is a direct tax levied on the net income or profit. Company Flat Taxes.